Know Your Investor (March Edition): Qiming Venture Partners

Shots:

- In this reprise, we feature Qiming Venture Partners again, based on the investments in 2023. With more than 600 investments to date, Qiming boasts a strong portfolio of companies involved in Technology & Consumer and Healthcare

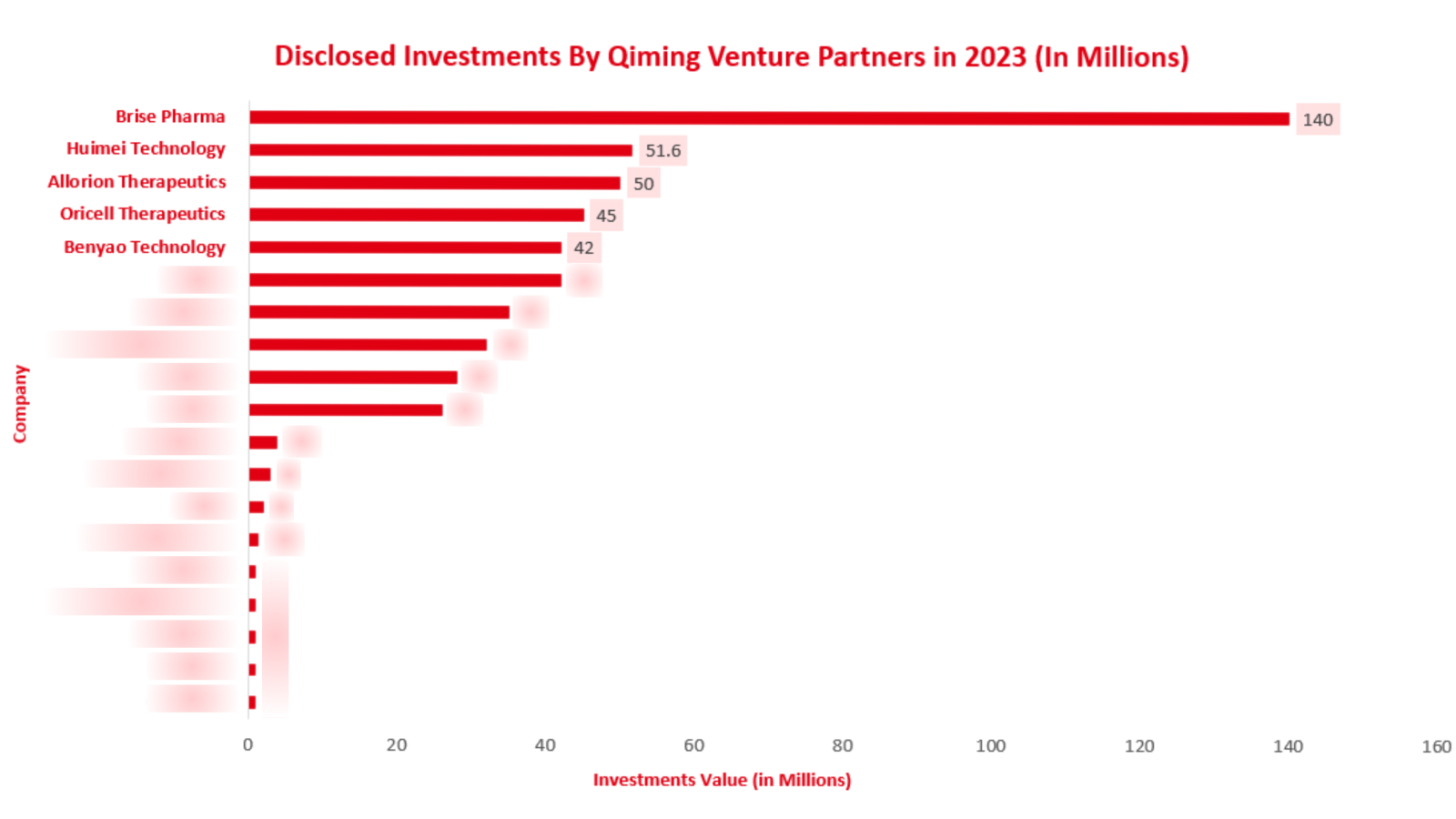

- In 2023, Qiming closed 38 funding rounds comprising 11 in the first quarter, 10 in the second, 11 in the third, and 6 in the fourth quarter respectively. The company’s highest investment in the seed stage was made to Brise Pharmaceuticals worth $140M

- For a detailed report on all the Qiming’s investments in 2023, reach out to us at connect@pharmashots.com with the subject line Qiming Venture Partners

Qiming Venture Partners

In 2006, Gary Rieschel and Duane Kuang laid the foundation of Qiming Venture. Based in China and headquartered in Shanghai, Qiming Venture holds a significant geographical presence with offices located in Beijing, Suzhou, Hong Kong, Singapore, Seattle, Boston, and San Francisco. Qiming’s professional investment team works closely under the expertise of its founders, entrepreneurs, scientists, engineers, doctors, consultants, and financial experts.

The company currently manages 11 funds in the United States and 7 in China while raising a total capital of $9.5B. Qiming divides its portfolio under two segments viz. Technology & Consumers (T&C) and the Healthcare. Qiming’s healthcare portfolio companies include Sesame Therapeutics, ChemLex, Horizone, Benyao Technology, OriCell Therapeutics Co. Ltd., and Cornerstone Robotics Ltd. among others.

Over the years, Qiming Venture participated in several investment rounds with roughly 600 investments in the healthcare sector, including companies dedicatedly working in biopharma, manufacturing, and services, along with devices and diagnostics.

In 2023, around 38 funding rounds were announced by Qiming Venture. As per the company’s quarterly distribution, 11 funding rounds were registered during the first quarter, 10 during the second, and 11 and 6 during the third and the fourth quarter respectively. Based on the series type, the company invested primarily in Series B. Out of the 38 rounds, 12 were made in Series B, 11 in Series A, whereas 9 were made in Seed Funding.

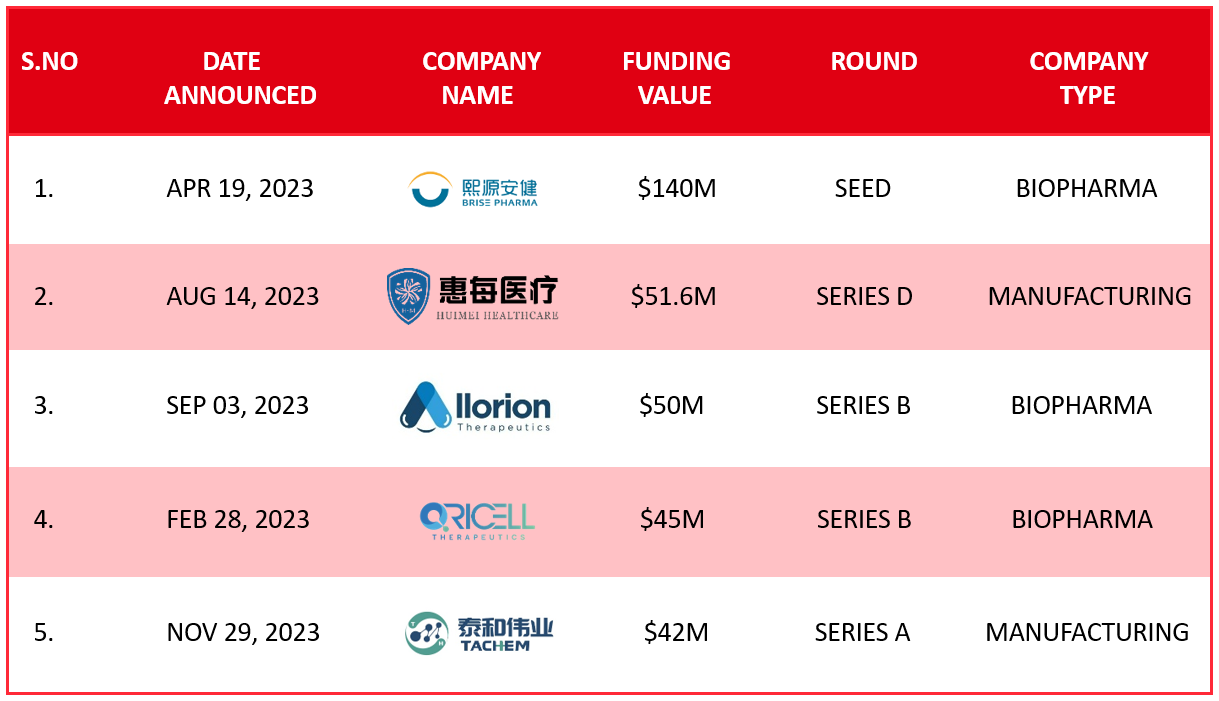

With a funding worth $140M, Qiming's highest Seed stage funding was made to Brise Pharmaceuticals, followed by a Series D funding of $51.6M to Huimei Healthcare and $50M in Series B funding to Allorion Therapeutics. In hindsight, 60% of the company's 2023 investments fell into one of two categories: Series A or Series B.

In 2023, Qiming partnered with companies focusing on Oncology, Cardiology, Genitourinary, Infectious Diseases, and Neurological Diseases. When it came to technologies, the major focus remained on Antibodies, Artificial Intelligence, Machine Learning, Devices, Gene Therapies, and Immunotherapies.

Around 19 investments were made in companies dealing in Manufacturing and Services. In this domain, Huimei Healthcare received the highest amount of funding worth $51.6M. The company made around 10 investments in Biopharma of which the investment made to Brise Pharmaceuticals worth $140M remained the highest.

Out of the total investments made by Qiming Venture Partners in 2023, 42.8% were under Series B, 28.9% under Series A, and 23.68% as Seed Funding. The top 3 investments made by Qiming Venture Partners were:

- Seed Funding worth $140M to Brise Pharmaceuticals

- Series D funding worth $51.6M to Huimei Healthcare

- Series B funding worth $50M to Allorion Therapeutics

The following table represents the top 5 funding rounds out of the 38 investments made by Qiming Venture in 2023:

Note: For a complete report, reach out to us at connect@pharmashots.com with the subject line "Qiming Venture Partners Data"

Related Posts: Know Your Investor (February Edition): F-Prime Capital Partners

Tags

Shivani was a content writer at PharmaShots. She has a keen interest in recent innovations in the life sciences industry. She was covering news related to Product approvals, clinical trial results, and updates. We can be contacted at connect@pharmashots.com.